The 3 Biggest Mistakes Homeowners Make When Buying Homeowners Insurance

Lubbock TX Homeowners Guide [3 Common Homeowners Insurance Mistakes] Buying homeowners insurance often feels like a box to check at closing. The paperwork is overwhelming, timelines are tight, and many homeowners assume all policies are basically the same. Unfortunately, that’s how costly mistakes happen. At Hettler Insurance Agency, we regularly review policies for homeowners insurance in Lubbock and West Texas and see the same issues again […]

Why Texas Home Insurance Rises Every Year? – Video KCBD TV News Lubbock

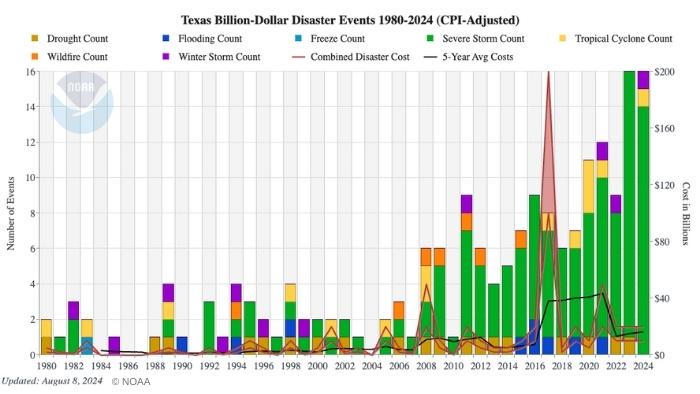

Has your home insurance premium skyrocketed? Well, you’re not alone. It’s a trend seen across the state of Texas (and across America). Texas has seen more billion-dollar weather disasters than any other state in recent decades. “If someone’s got a rate decrease, they are a very lucky and very rare individual,” Ronald Hettler said, president of Hettler Insurance Agency in Lubbock, Texas. Due to sustained and lengthy inflation (technically it's been a few years of recession), some homeowners have reported a quadruple increase in homeowners insurance policy cost.

Homeowner’s Insurance: 7 Great Tips To Save Money

Homeowner’s insurance is a necessity, for all property owners. For instance, it might not be required by law, but if you borrow money to buy a home, your mortgage lender will most usually require you to have homeowner’s insurance. This helps to protect their investment and yours. If your home loan is completely paid off, it’s still smart to continue homeowner’s insurance. You want to […]

Lubbock: Bundle your Home and Auto Insurance to save

Buying insurance in Lubbock is quite a shock for many who move here from other parts of the country. They can’t believe that home insurance can cost so much. When I moved to Lubbock over 30 years ago, the cost of my home insurance doubled while the amount of coverage decreased 25%. Lubbock area deductibles also are normally 1% of the value of your home. […]

Which Deductible Should I Buy?

Low deductibles are great when the claim occurs but rarely are they the best long term decision. O.K. Let’s start this discussion with a trip to Las Vegas. Odds are, if you are reading this, you don’t live in Vegas so a trip is within the sphere of imagination for you. See this decision is all about odds.

New Client’s Home and Auto Insurance savings are $1,300 HUGE!

So I was at the Lubbock, Texas Parade of Homes last week and saw a friend that said he wanted to call me about his home and auto insurance. He called me that following Monday and a couple of days later, Hettler Insurance wrote his auto insurance policy. I didn’t know what he was paying through his long time agent, but I did know that […]

Should you shop your Auto Insurance and Home Insurance coverage together?

We get calls all the time from families wanting us to shop their auto insurance. We put all the information into the rating program and get quotes back from up to 8 companies. But many times the substantial savings that we show the customer is “eaten up” by the loss of a multi-policy discount on their home insurance.

Why should I insure my home for replacement cost?

Over and over again for the past 30 years, I have heard the complaint that the amount of coverage on my home on my homeowner’s insurance policy is way more than the home’s market value. Sometimes you insure even a newly constructed home for more than what you just paid! A seemingly excess amount of coverage is a valid concern because it seems a bit unethical to insure your home for […]

Hartford to launch new homeowners policy

On July 9th, 2011, Hartford Insurance has announced they will begin offering a new home protection product. This new policy will have the option of covering mechanical systems such as air conditioners and refrigerators for mechanical breakdown. (Refer to policy for complete details.)

Hettler Insurance launches new website

Ronald Hettler, CIC of Hettler Insurance Agency in Lubbock, TX announces the launch of their newly designed website serving insurance buyers throughout Texas. On their site, you may quote and/or purchase auto insurance, home insurance, renters insurance, and health insurance. Hettler Insurance Agency is an independent agency represents dozens of carriers including Travelers, Progressive, Safeco, Hartford, and Blue Cross Blue Shield of Texas. For more information visit: www.hettlerinsurance.com or […]