Why Texas Home Insurance Rises Every Year? – Video KCBD TV News Lubbock

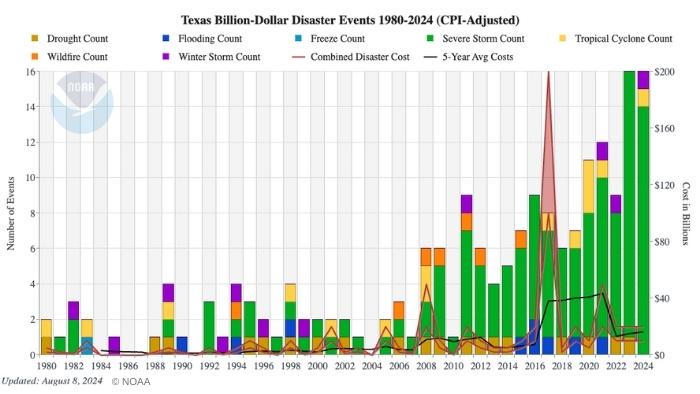

Has your home insurance premium skyrocketed? Well, you’re not alone. It’s a trend seen across the state of Texas (and across America). Texas has seen more billion-dollar weather disasters than any other state in recent decades. “If someone’s got a rate decrease, they are a very lucky and very rare individual,” Ronald Hettler said, president of Hettler Insurance Agency in Lubbock, Texas. Due to sustained and lengthy inflation (technically it's been a few years of recession), some homeowners have reported a quadruple increase in homeowners insurance policy cost.

Home Insurance Meets Ladder Safety Month

What does homeowners insurance have to do with Ladder Safety Month? Well… falling from a ladder is fairly common (annually, 500,000 people are treated). People often assume that their homeowners insurance covers anything that happens in and around their home, including the people living inside. There are some limits. A home insurance policy is designed to cover your home and belongings (things), and the injuries […]

Top 10 Worst ROI Home Improvements [infographic]

Home improvement and return on investment (ROI). Do these two things go together? – [see infographic below] We all have a few little things that we’d like to change about our home, right? But, have you considered that not all improvements are actually financially wise. Consider your Return On Investment (ROI). Just because it’s a significant home improvement doesn’t mean that it will pay for […]

Homeowner’s Insurance: 7 Great Tips To Save Money

Homeowner’s insurance is a necessity, for all property owners. For instance, it might not be required by law, but if you borrow money to buy a home, your mortgage lender will most usually require you to have homeowner’s insurance. This helps to protect their investment and yours. If your home loan is completely paid off, it’s still smart to continue homeowner’s insurance. You want to […]

[Video] Is Lubbock Texas A Great Place To Live?

Why Is Lubbock Texas A Great Place To Live? Watch the video to see just a few of the reasons. [this article has been reformatted from an earlier piece] City of Lubbock Lubbock is the 11th largest city in the state of Texas. Lubbock falls in the top 100 most populated cities in the United States with a population of more than 300,000 people. In […]