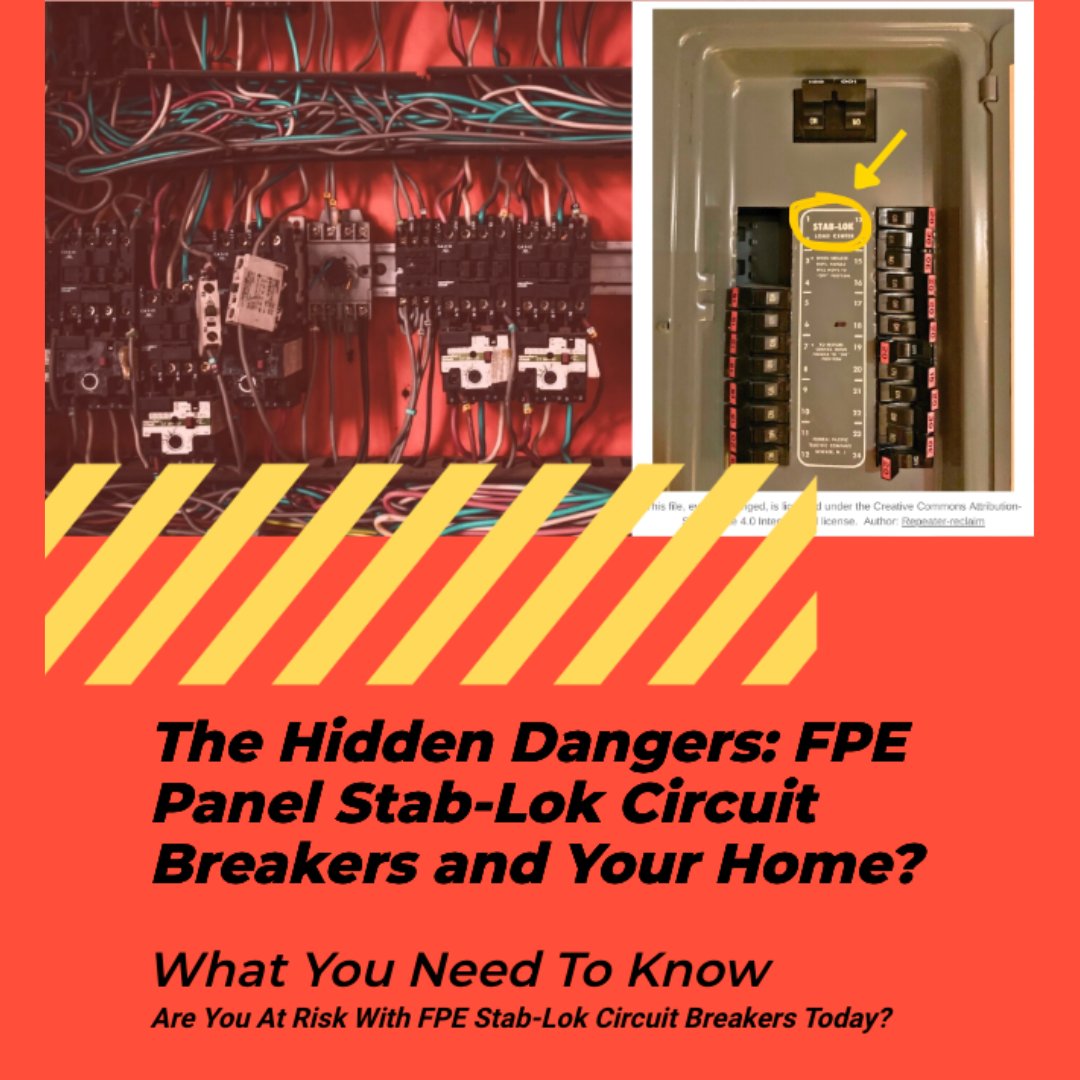

Danger: FPE Panel Stab-Lok Circuit Breakers

Download ebook. As a homeowner, or business-owner, your top priority is the safety of your family and your property. While you may not think about it often, your electrical panel plays a crucial role in keeping your home, or business, safe by preventing electrical fires.

Home Insurance Meets Ladder Safety Month

What does homeowners insurance have to do with Ladder Safety Month? Well… falling from a ladder is fairly common (annually, 500,000 people are treated). People often assume that their homeowners insurance covers anything that happens in and around their home, including the people living inside. There are some limits. A home insurance policy is designed to cover your home and belongings (things), and the injuries […]

Homeowner’s Insurance: 7 Great Tips To Save Money

Homeowner’s insurance is a necessity, for all property owners. For instance, it might not be required by law, but if you borrow money to buy a home, your mortgage lender will most usually require you to have homeowner’s insurance. This helps to protect their investment and yours. If your home loan is completely paid off, it’s still smart to continue homeowner’s insurance. You want to […]

How To Prepare Before Buying Homeowners’ Insurance

Do your homework before getting homeowners’ insurance. Use this list and consult your independent insurance agent so they can do some comparison shopping for your home insurance. After you look over all the facts related to your dwelling, you and your agent will be prepared and ready to get the best deal on your homeowners’ insurance policy. How much you know about each of the […]

Is Your Lubbock Home or Business In a Floodplain?

Imagine wading through your water-filled home or business finding many of your most cherished and vital possessions waterlogged and forever ruined. Unfortunately, each year many Texans don’t have to imagine this scenario and instead face it head on. Texas consistently has some of the highest fatality rates and property damage costs due to flooding. Let’s face it, next to fire or tornado/hurricane damage there are […]

Hettler Insurance Expands Partnership with Auto and Home Carriers

New Appointments Increase Auto Carriers to 13 and Property Carriers to 20 Today, Hettler Insurance Agency announced it is appointed to quote State Auto Insurance Company and Hippo Insurance. Hettler Insurance is now an authorized agency with 13 different companies for vehicle policies and 15 for property (homeowners, renters, condo).

4 Reasons Lubbock Texas is Dangerous

Steady economic growth, a low cost of living and growing population make Lubbock, TX a great place to call home and live. Over 300,000 people call Lubbock home and the city is expected to grow 7% through 2022. Our diverse economy and job market outpace many other areas of the United States.

When a Homeowners Policy Increases

Should You Stay or Jump? Jim and his wife Nancy just celebrated their second year in a beautiful new home. The celebration didn’t last long, however, when the couple discovered their homeowners policy increased 35% versus the previous year! Even worse, the rate hike occurred without any claim activity and very little credit changes. Maybe you’ve also felt Jim’s pain. It’s an all too common […]

Wildfire Season in West Texas

Wildfire Risk & Getting Insurance Texas is second only to California as the state most at risk for wildfire, according to analytics company CoreLogic. At least 715,300 Texas residences are at high or extreme risk of wildfire. A dry environment goes hand in hand with wildfire. West Texas and the Panhandle are receiving less rainfall each year, earning long term drought status. There is a […]

Insuring a Tiny House in Texas

The Tiny House Trend Most people have heard of the tiny house trend. But just how tiny are these homes? There’s no official definition, but most people consider a house less than 400 square feet as tiny. The average tiny house is only 186 square feet. This includes the living area, bathroom, kitchen and sleeping loft. Compare this to the average American house, which is […]

Protecting Your Property for Storms in Lubbock

Now that the year is almost over, it’s time to evaluate 2016’s storm season in Lubbock and the greater south plains. We interviewed Joel Mowery, Co-Owner of SERVPRO of Southwest Lubbock. Together with Ron Hettler, President of Hettler Insurance, we have two experts on protecting property and restoring what is lost after a disaster.

How Will Climate Change Affect Insurance in Texas?

All Texans know that we live in the greatest state on earth. As such, we don’t like to be bothered by problems that divert us from advancing our business, socializing or just relaxing with some Friday night football. So it’s no wonder that many folks don’t want to face the frightening and highly inconvenient problem of climate change. But it’s here, and a spate of […]

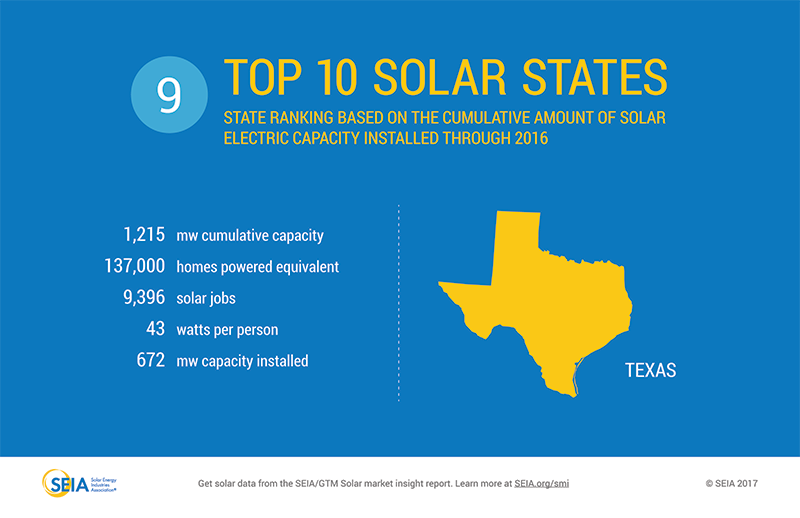

Solar Powered Homeowners Insurance in Texas

Solar energy has become increasingly popular across the US. According to the Solar Energy Industries Association, solar panel installation increased 16 percent from 2014 to 2015. More impressive, for the first time, solar overtook natural gas in new installations.