Imagine wading through your water-filled home or business finding many of your most cherished and vital possessions waterlogged and forever ruined. Unfortunately, each year many Texans don’t have to imagine this scenario and instead face it head on. Texas consistently has some of the highest fatality rates and property damage costs due to flooding. Let’s face it, next to fire or tornado/hurricane damage there are few things in the insurance world that are worse than a flooded home. And just because your property may be located outside a floodplain doesn’t mean you’re not at risk.

Do You Need Flood Insurance?

A floodplain is an area in Texas that has a 1% chance of being flooded in any given year. If your home is in a designated floodplain, you are typically required to have flood insurance by your mortgage lender.

Homeowners policies don’t cover flood damage, defined as two or more areas affected by rising water or mudflow. Instead a separate flood insurance policy is necessary to receive coverage. Anywhere it rains heavily, can also flood, all regions in the Lone Star state are at risk–both inside and outside floodplains.

According to the Texas Department of Insurance (TDI), Texas is especially prone to flash flooding and nearly every major city in Texas is in an area at high risk. Floods in 2016 affected large areas of Houston, central Texas and the West. In fact, more than half of homes flooded by Hurricane Harvey in 2017 were located outside of designated floodplains. According to U.S. Federal Emergency Management Agency (FEMA), 25% of all flood claims occur outside the floodplain, so even when coverage isn’t required, it doesn’t necessarily mean your property is safe.

Severe flooding in Brookshire, Texas, April 20, 2016. Texas Guardsmen and partner first responders patrolled the flooded areas looking to help Texans in need. (U.S. Army National Guard photo by 1st Lt. Zachary West/ Released)

In the event a federal emergency is declared, disaster loans average less than $10,000, and significant damage to your home, business or personal property can quickly exceed this amount. When you combine the average cost of cleaning, replacing hardwood flooring and carpets, mold remediation, window trim, door repair, and wall repair, the average U.S. homeowner faces anywhere from $21,000 to $26,000 in repair costs. For natural disasters this figure can be much higher.

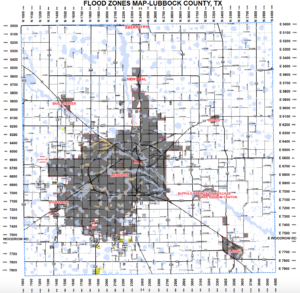

Oftentimes flood maps are difficult to keep up to date, so if you are currently located outside the floodplain, your risk isn’t necessarily less. How is this possible? It can be caused by growth and urban sprawl, which are common in Lubbock and other Texas cities increases flood risk. When absorbent prairies and pastures are torn up and replaced by concrete and asphalt roads and buildings, it can put areas that never flooded before at much greater risk. According to Joel Mowery, Co-Owner of SERVPRO of Southwest Lubbock, “The Lubbock area had heavier rains and flooding…we had customers that were devastated where their house was full of water and they had no flood coverage.” It has now become common for devastating storms to affect Lubbock at least once a year. That’s why it’s a great idea to purchase flood insurance regardless of your location on a flood map.

Several areas within the flood zone include Primrose Pointe, McAlister Park, Kings Park, Melonie Park along Restaurant Row, Ballenger, Bayless Atkins, and the Lubbock County Courthouse. Source

The average flood policy costs less than $700 a year in Texas, and varies depending on your flood risk, the value of your home, the amount of your deductible, and your location. Texans living outside floodplain areas can often expect to spend around $300 a year, so coverage is affordable and provides peace of mind in case disaster strikes. A knowledgeable insurance agent can help you navigate the various flood insurance waters to help you unlock the best rate. For example, if you have an FHA mortgage, you would be required to buy FEMA insurance. If, however, you have a conventional home loan, you can buy private flood insurance and access a competitive flood insurance policy rate. Every situation is different and requires the expertise of a licensed insurance agent.

Regardless of your situation or location, keep in mind most flood policies have a 30-day waiting period before kicking in, so don’t wait for an approaching storm before deciding to buy coverage! The best thing you can do is contact one of our licensed insurance agents today. Hettler Insurance Agency has been in business since 1992 and have helped Lubbock homeowners and businesses weather many storms! Our experience gives you competitive options, and the confidence that comes with protecting your property from flood damage through reliable coverage. Don’t delay, contact us for a quote today! Our office phone number is (806) 798-7800.

-- Life Insurance Instant Quote and Apply Tool @ GetLifePolicy.com > * Quick self-service term life insurance quote. With or without medical exam.

-- Call us about Auto, Home, Business, Life, or Health insurance. * Click to Call (806) 798-7800, Mon-Fri 8:30am-5pm (lunch closed Noon-1pm)

-- Come see us @ our new address 4720 S Loop 289 Lubbock, TX 79414 (maps link), or get your online quote started at https://GetHettler.com