Wildfire Risk & Getting Insurance

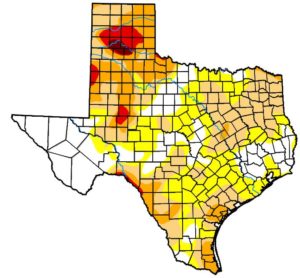

Texas is second only to California as the state most at risk for wildfire, according to analytics company CoreLogic. At least 715,300 Texas residences are at high or extreme risk of wildfire.

A dry environment goes hand in hand with wildfire. West Texas and the Panhandle are receiving less rainfall each year, earning long term drought status. There is a high risk of wildfire affecting Lubbock and surrounding communities during certain months of the year.

Where there is risk of losing it all, there is a need for adequate insurance. As wildfire season causes more and more damage to this area of the state, we advise individuals and businesses revisit property insurance policies.

Drought in Lubbock

Fluctuating rainfall is nothing new for Lubbock County. The area has experienced dry spells before, and torrential rains. The county’s driest times of record include:

Fluctuating rainfall is nothing new for Lubbock County. The area has experienced dry spells before, and torrential rains. The county’s driest times of record include:

- 2017 – 2018: 99 days without any moisture, setting a record!

- 2005-2006: 98 days without precipitation

- 1921 – 1922: 88 bone dry days

Texas has also seen a recent downturn in rainfall. In January 2017, 7.66 percent of Texas suffered drought. At the end of January 2018, more than 86 percent of Texas was experiencing drought conditions, according to Richard Heim, a drought specialist and meteorologist with National Oceanic and Atmospheric Administration.

Flash flooding often follows droughts. In past years, flash flooding has led to costly damage to Lubbock County’s infrastructure and agriculture. And neither drought nor flash flooding are good for cotton, which Lubbock County produces more of than any other area in the state.

Wildfires

As of June 2018, Lubbock is still in a severe drought. Meanwhile, West Texas firefighters have fought to control wildfires raging from the 20-acre Lake Bottom Fire near Wolfforth, in Lubbock County, to the enormous 11,135-acre Yarbrough Fire. Grass fires are also common in the area.

According to the U.S. Department of Interior, about 90 percent of wildland fires are human-caused. This could be from a tossed cigarette, unattended campfire or burning trash. Lightning accounts for the remaining 10 percent. All it takes is one carelessly thrown cigarette or a single storm to spark a fire. Combined with the high winds of West Texas and there could be millions in property damage.

As of April 2018, 45 fires were fought in the Panhandle with 120 homes affected, 11 homes were lost.

Insurance

With this dangerous duo of drought and fire, how do you protect your property? If you live in a high-risk area, you’ll want to be sure your property is protected from wildfire damage.

A high-risk home for wildfire claims can be:

- Near uncleared land, such as the outskirts of city limits, close to cotton fields and ranchland.

- Rural homes that are far from a local fire department and without fire hydrant access

- Vacation home that is seldom occupied and in a remote location

- One of the newest homes in a development. Over time once homes are built, the risk will decrease.

Although the South Plains isn’t known for forests or trees, we do have plenty of cotton and small shrubs and brush do burn in drought conditions. To buy home insurance for a property at high risk of wildfire, it helps to shop around. Many carriers will exclude coverage for wildfires and even deny an application.

Carriers that write options for wildfires evaluate the percentage of brush on and near your property. It’s a rough estimate of the risk potential.

NOW is the time to review your home insurance plan, before a hot summer intensifies wildfire season. Consider the cost to rebuild your home, the cost of your personal belongings, and whether you have landscaping and additional structures that need protection. You may need to extend your coverage for peace of mind. Your insurer can help you make the best decisions.

Preparedness

If you live in Texas or other areas prone to wildfires, preparedness is crucial.

- You and your family should designate an emergency meeting location to be sure everybody has safely evacuated.

- Have fire extinguishers in your house and train all family members to use them.

- Everybody should know the locations of shut-off controls for water, gas and electric, and how to shut them down safely. Keep an emergency supply kit in your vehicle, and don’t forget pet supplies.

- Dogs are easy to leash, but all family members should know where the cat carrier is in case somebody needs to shove Fluffy in and make a quick getaway.

- If you have farm animals, plan for their evacuation, too.

Contact us today

Don’t wait until you’re staring down flames. Get your policy in order today. Your independent agent is ready to help. Give us a call.