Why Texas Home Insurance Rises Every Year? – Video KCBD TV News Lubbock

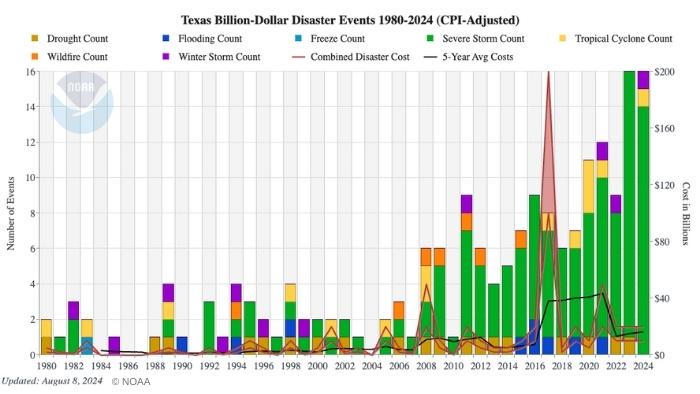

Has your home insurance premium skyrocketed? Well, you’re not alone. It’s a trend seen across the state of Texas (and across America). Texas has seen more billion-dollar weather disasters than any other state in recent decades. “If someone’s got a rate decrease, they are a very lucky and very rare individual,” Ronald Hettler said, president of Hettler Insurance Agency in Lubbock, Texas. Due to sustained and lengthy inflation (technically it's been a few years of recession), some homeowners have reported a quadruple increase in homeowners insurance policy cost.

New Client’s Home and Auto Insurance savings are $1,300 HUGE!

So I was at the Lubbock, Texas Parade of Homes last week and saw a friend that said he wanted to call me about his home and auto insurance. He called me that following Monday and a couple of days later, Hettler Insurance wrote his auto insurance policy. I didn’t know what he was paying through his long time agent, but I did know that […]

Should you shop your Auto Insurance and Home Insurance coverage together?

We get calls all the time from families wanting us to shop their auto insurance. We put all the information into the rating program and get quotes back from up to 8 companies. But many times the substantial savings that we show the customer is “eaten up” by the loss of a multi-policy discount on their home insurance.

Why should I insure my home for replacement cost?

Over and over again for the past 30 years, I have heard the complaint that the amount of coverage on my home on my homeowner’s insurance policy is way more than the home’s market value. Sometimes you insure even a newly constructed home for more than what you just paid! A seemingly excess amount of coverage is a valid concern because it seems a bit unethical to insure your home for […]