# home insurance, homeowners insurance, Lubbock home insurance, Texas home insurance, Texas homeowners insurance, independent insurance agent, Lubbock insurance, Hettler Insurance Agency

(first published by KCBD News Lubbock. Below version edited to include many more facts, information and extra visuals.) – “Why Texas home insurance continues to rise year after year” – originally by Parker Shofner, Published: Aug. 23, 2024 at 5:05 PM CDT, Lubbock, Texas (KCBD)

Has your home insurance premium skyrocketed? Well, you’re not alone. It’s a trend seen across the state of Texas (and across America). Texas has seen more billion-dollar weather disasters than any other state in recent decades.

“If someone’s got a rate decrease, they are a very lucky and very rare individual,” Ronald Hettler said, president of Hettler Insurance Agency in Lubbock, Texas.

Due to sustained and lengthy inflation (technically it’s been a few years of recession), some homeowners have reported a quadruple increase in homeowners insurance policy cost. Analysis of data from the Texas Department of Insurance (TDI) shows that insurance carriers asked the state to approve double-digit rate increases more than 150 times in 2023. So far this year in 2024, the carriers asked for 74 more double-digit increases, with one company asking for an increase of 73%. According to NBC5DFW, NBC 5 data shows that the number of double-digit rate increases requested in Texas has increased by 560% since 2014.

In 2023, Texas home insurance premiums have increased significantly, with some key findings from the Texas Department of Insurance (TDI) and other sources including:

Rate increases:

Insurance companies requested double-digit rate increases more than 150 times in 2023.

Rate filings:

The TDI reviewed 2,923 rate filings in 2023, approving 2,663, rejecting 100, and withdrawing 160.

Rate approvals:

In the fourth quarter of 2023, Texas regulators approved 46 rate increases, including four of the 10 most significant in the country.

Rate reasons:

The main reasons for the increase in rates are high inflation and the cost of building supplies, as well as the impact of natural disasters in Texas.

Rate enforcement:

The TDI requires insurance companies to charge fair, reasonable, and adequate rates. If the TDI finds that a company’s rates are too high, it can require the company to refund overcharged customers.

According to the Texas Department of Insurance, the average homeowner’s annual premium in 2013 was $1,646. But, in 2022, that number jumped to $2,374. According to insurance.com, the cheapest in 2024 is $2,972. Texas is said to be about 88% higher than the national average and the fourth highest rate in the country.

In 2023, the average cost of homeowners insurance in Texas increased by 23%, which was the highest increase in the country. In June 2023, the average annual cost of homeowners insurance in Texas was $3,875 per year, which is 113% higher than the national average of $1,820. The cost of home insurance in Texas varies by city, with Houston being the most expensive at $4,595 per year, followed by Fort Worth at $4,535 per year, Dallas at $4,255 per year, and Austin at $2,580 per year.

Why so much? Here are the main factors that contribute to the high cost of homeowners insurance in Texas:

Severe weather:

Texas experienced more billion-dollar disasters in 2023 than any other year on record. Since 1980, Texas has experienced $402 billion in damages due to severe weather events. Texas is prone to hurricanes, wildfires, tornadoes, and hail.

Economic factors:

Inflation (it’s a hard fact, and the MAIN culprit) and low-interest rates have also contributed to the increase in home insurance rates in Texas. Severe weather contributes to higher construction and labor costs which in turn is passed on to the insurance industry and consumers.

Coverage:

The amount of coverage you need can also affect the cost of your insurance. For example, if you live in a more expensive home and need $500,000 in dwelling coverage, you could pay between $3,400 and $10,600 per year.

Population Growth:

Texas’ population has increased rapidly in the past 10 years.

TEXAS Average Homeowner’s Insurance Annual Premium

| Year | Average Texas Premium |

|---|---|

| 2013 | $1,646 |

| 2014 | $1,746 |

| 2015 | $1,782 |

| 2016 | $1,792 |

| 2017 | $1,860 |

| 2018 | $1,916 |

| 2019 | $1,961 |

| 2020 | $1,987 |

| 2021 | $2,124 |

| 2022 | $2,374 |

| 2023 | $3,875 |

| 2024 , [national average is $2,511] | Average: $4,647 , [Cheapest: $2,972] |

Table: NBC 5 Investigates , Source: Texas Department of Insurance

“Probably in the top three, depending on where you live in the state. We might be the top one in increases percentage wise,” Hettler said. Ronald Hettler, a local independent insurance agent in Lubbock, Texas, says the increases are due to a couple of factors.

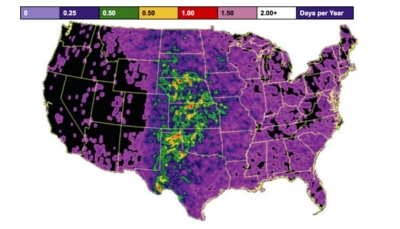

“Weather catastrophes and inflation, those are the only, those are the two drivers of what is going on right now,” Hettler said. (FYI: just one afternoon hailstorm can cause $1 billion in insurance losses. North Texas to West Texas is actually part of a Texas “Hail Belt” running roughly from Dallas to Amarillo to Lubbock to Odessa to Abilene and back.)

Where does it hail the most in Texas? Many would say that in the northwest part of the state, Lubbock is in the heart of Texas’ “Hail Belt”. This city of about 300,000 is no stranger to hail, with storms often bringing large, damaging hailstones that impact homes, businesses, and agriculture.

Texas is part of a region known as “Hail Alley” that stretches from Texas to the Dakotas and includes parts of Oklahoma, Kansas, Nebraska, Colorado, Wyoming, and South Dakota. It’s most often in a triangular region from West Texas to northwest Missouri to the western Dakotas. This area is known for its frequent and severe hailstorms, which are caused by a combination of factors like wind patterns, temperature differentials, and moisture content. In the spring and summer, warm, moist air from the Gulf of Mexico meets cold, dry air from Canada, creating thunderstorms that can produce hail. The hail can also stay frozen on its way down due to a cold belt in the atmosphere that reaches freezing temperatures.

In Texas, the Hill Country, North Texas, and West Texas experience severe weather patterns, but Northern and Northwest Texas see the most hailstorms. Hail season in Texas usually lasts from March to May. In 2023, Texas saw the highest number of hailstorms in the country, with an average of $7.9 million in property damage. Preliminary data for 2024 suggests that hail damage in Texas could exceed $28 billion. The size of hailstones has also increased over the past decade, with some hailstones in Northern Texas reaching DVD size. Homeowners can help prepare for hailstorms by installing metal roofs and other measures to mitigate potential damage.

Trivia: According to Wikipedia, the most expensive hailstorm in US history struck the I-70 corridor of eastern Kansas, across Missouri, into southwestern Illinois producing many baseball-sized hail reports.

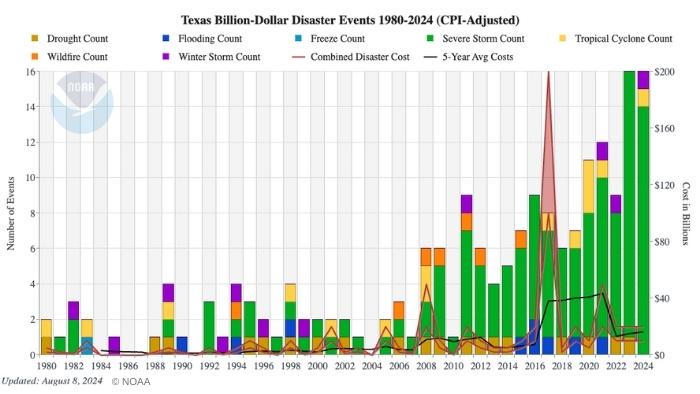

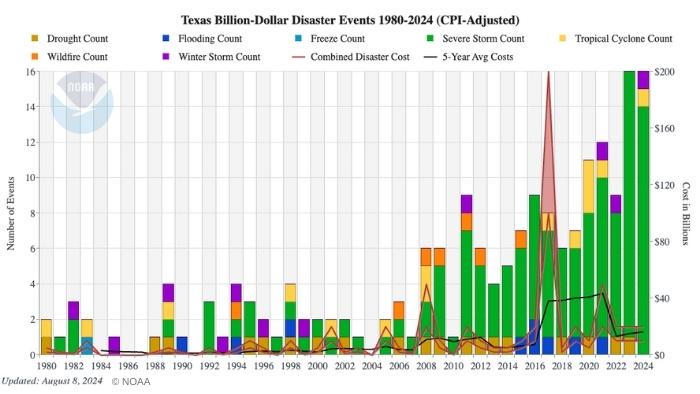

Since 1980, there have been 179 weather disasters in Texas that have each totaled more than a Billion dollars in damage. 32 of those were this year and last year alone (that’s 17.8% of the disasters in the last 44 years). If there were 32 every year during those 44 years, then we would have had 1,408 Billion dollar disasters instead of 179. The period shown in the chart amounts to accumulating costs of almost $3 Trillion worth of disasters. Notably, the U.S. weathered 28 such events in 2023 alone with damages totaling $92.9 billion nationwide. Natural hazard events pose investment risks through: costly physical damage; depreciation of productivity and capital; supply chain disruptions; reduced tax basis due to migration; increased insurance rates; and a general rise in uncertainty.

Texas Billion-Dollar Disaster Events 1980-2024 (CPI-Adjusted)(NOAA)

More disaster events are expected as hurricane season doesn’t end until November 30.

“Insurance companies don’t worry about the million-dollar claims, I mean they worry about them because they are big deals, but Billion-dollar claims are really attention getters,” Hettler said.

That’s because reinsurance costs are up as well, which are what insurance companies pay to help cover those billion-dollar claims. Yes, there are even bigger insurance companies (called re-insurance) that sell insurance to the major carriers like Progressive, Geico, etc. The insurance industry is multi-layered.

“They actually buy insurance to cover the really big claims, well the claims the primary carriers are seeing are being felt by the carriers they employ called reinsurers, and reinsurers are saying ‘Oh we need more money too,’” Hettler said. — Inflation isn’t helping either. Hettler says the cost of roofing materials alone has risen by 40% in the last 3 years.

“You’ve got weather combined with increased cost of materials and you just add them together and it’s an ugly picture,” Hettler said.

Thankfully, there are things you can do to lower your rates.

Including increasing your deductible, improving your credit score, and calling your independent insurance agent to make sure you’re getting all the discounts you’re eligible for.

“Every once in a while, you might be with the wrong company, every once in a while. I’m not saying that is a common thing. Right now, everyone is going up, you’re not getting picked on, but comparing time to time and going to the marketplace is always a good idea,” Hettler said.

Texas Lieutenant Governor Dan Patrick and House Speaker Dade Phelan have ordered committees to hold hearings on insurance premiums before the legislature meets in January. The focus will be on the effect of rising costs and a search for ways increase consumer transparency.

(some content above Copyright 2024 KCBD. All rights reserved.)

Why Does My Insurance Continue to Go Up?

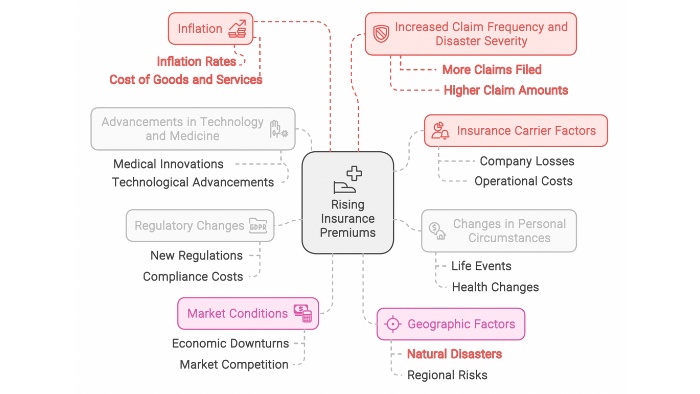

Insurance premiums can be a significant part of your monthly expenses, and it can be frustrating to see them increase year after year. The chart below aims to explore the various reasons why your insurance costs might be rising, providing a comprehensive understanding of the factors at play. Notice the chart below: The highlighted factors are the MAIN factors that have affected Texas homeowners insurance: 1. Inflation, 2. More natural disaster claims.

Summary:

Insurance premiums are influenced by a multitude of factors, many of which are beyond the control of the individual policyholder. Understanding these factors can help you make more informed decisions about your coverage and potentially find ways to combat rising costs. This article will dive into the primary reasons for increasing insurance premiums, including risk factors, market conditions, and individual circumstances. Note the red & pink markers in the chart. Factors Contributing to Rising Insurance Premiums:

1. **Inflation**

Inflation affects the cost of everything, including insurance. As the cost of goods and services increases, so does the cost of claims. Insurance companies adjust premiums to keep pace with inflation and ensure they can cover future claims. Unfortunately, the insurance carrier companies have to do this to stay in business. Realistically, if they don’t stay in business, then no one will have insurance. It’s a double-edged sword.

2. **Increased Claim Frequency and Disaster Severity**

If there is a rise in the number of claims or the severity of those claims, insurance companies may increase premiums to cover the higher costs. For example, natural disasters, car accidents, or health issues can lead to more claims and higher payouts.

3. Changes in Personal Circumstances

Your personal circumstances, such as changes in your driving record, health status, or credit score, can impact your insurance premiums. For instance, a speeding ticket or a new medical condition can lead to higher premiums.

4. Regulatory Changes

Changes in laws and regulations can also affect insurance premiums. New regulations may require insurance companies to provide additional coverage or adhere to stricter standards, leading to increased costs that are passed on to policyholders.

5. Market Conditions

The insurance market itself can influence premium rates. Factors such as competition, investment returns, and overall economic conditions can lead to adjustments in premium pricing.

6. Geographic Factors

Where you live can significantly impact your insurance costs. Areas prone to natural disasters, high crime rates, or heavy traffic may see higher premiums due to the increased risk of claims.

7. Advancements in Technology and Medicine

While advancements in technology and medicine can lead to better outcomes, they often come with higher costs. For example, new medical treatments or advanced car safety features can be expensive, leading to higher insurance premiums to cover these costs.

8. Company-Specific Factors

Each insurance company has its own underwriting criteria and risk assessment methods. Changes in a company’s financial health, claims experience, or business strategy can lead to adjustments in premium rates.

Conclusion

Understanding why your insurance premiums continue to rise involves looking at a variety of factors, many of which are interconnected. While some of these factors are beyond your control, being aware of them can help you make more informed decisions about your insurance coverage. Shopping around for the best rates, maintaining a good driving record, and staying informed about changes in the insurance market can help you manage and potentially reduce your insurance costs.

-- Life Insurance Instant Quote and Apply Tool @ GetLifePolicy.com > * Quick self-service term life insurance quote. With or without medical exam.

-- Call us about Auto, Home, Business, Life, or Health insurance. * Click to Call (806) 798-7800, Mon-Fri 8:30am-5pm (lunch closed Noon-1pm)

-- Come see us @ our new address 4720 S Loop 289 Lubbock, TX 79414 (maps link), or get your online quote started at https://GetHettler.com