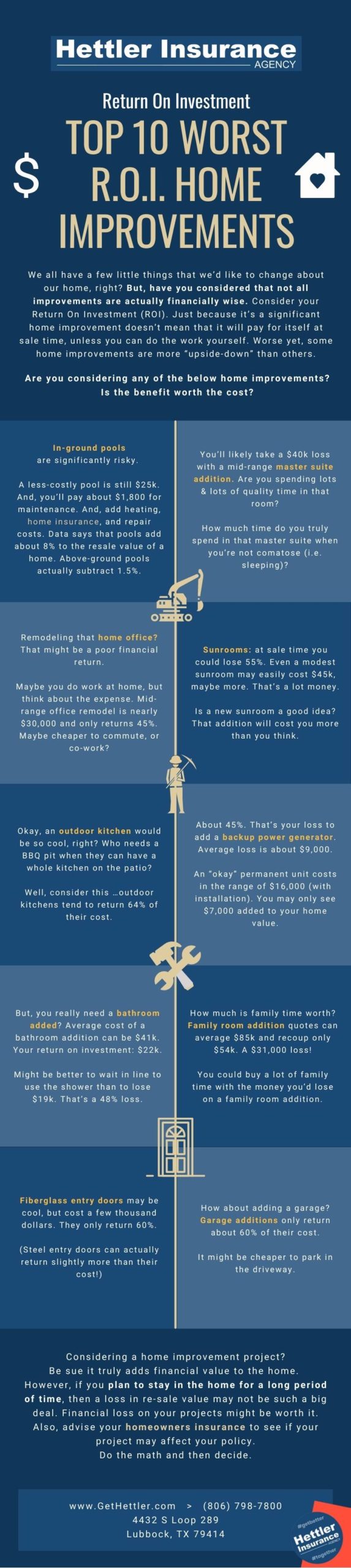

Home improvement and return on investment (ROI). Do these two things go together? – [see infographic below]

We all have a few little things that we’d like to change about our home, right? But, have you considered that not all improvements are actually financially wise. Consider your Return On Investment (ROI). Just because it’s a significant home improvement doesn’t mean that it will pay for itself at sale time, unless you can do the work yourself. Worse yet, some home improvements are more “upside-down” than others.

[See related article @ Home Renovation Strategies and Long-Term Value Investments Pay Off]

Are you considering any of the below home improvements? Is the benefit worth the cost?

1. In-ground pools are significantly risky.

A less-costly pool is still $25k. And, you’ll pay about $1,800 for maintenance. And, add heating, homeowners insurance, and repair costs. Data says that pools add only about 8% to the resale value of a home. Above-ground pools actually subtract 1.5%.

2. Master suite addition

You’ll likely take a $40k loss with a mid-range master suite addition. Are you spending lots & lots of quality time in that room? How much time do you truly spend in that master suite when you’re not comatose (i.e. sleeping)?

3. Remodeling that home office?

That might be a poor financial return. Maybe you do work at home, but think about the expense. Mid-range office remodel is nearly $30,000 and only returns 45%. Maybe cheaper to commute, or co-work?

4. Sunrooms: at sale time you could lose 55%.

Even a modest sunroom may easily cost $45k, maybe more. That’s a lot of money. Is a new sunroom a good idea? That addition will cost you more than you think.

5. Outdoor kitchen

Okay, an outdoor kitchen would be so cool, right? Who needs a BBQ pit when they can have a whole kitchen on the patio? Well, consider this … outdoor kitchens tend to return 64% of their cost.

6. Backup power generator

About 45%. That’s your loss to add a backup power generator. Average loss is about $9,000. An “okay” permanent unit costs in the range of $16,000 (with installation). You may only see $7,000 added to your home value.

7. Bathroom addition

But, you really need a bathroom added? Average cost of a bathroom addition can be $41k. Your return on investment: $22k. Might be better to wait in line to use the shower than to lose $19k. That’s a 48% loss.

8. Family room addition

How much is family time worth? Family room addition quotes can average $85k and recoup only $54k. A $31,000 loss! You could buy a lot of family time with the money you’d lose on a family room addition.

9. Fiberglass entry doors

Fiberglass entry doors may be cool, but cost a few thousand dollars. They only return 60%. (Steel entry doors can actually return slightly more than their cost!)

10. Garage addition

How about adding a garage? Garage additions only return about 60% of their cost. It might be cheaper to park in the driveway.

Conclusion

Considering a home improvement project? Be sure it truly adds financial value to the home. However, if you plan to stay in the home for a long period of time, then a loss in resale value may not be such a big deal. Financial loss on your projects might be worth it. Also, advise your home insurance agent to see if your project may affect your policy. Do the math and then decide.

Infographic Top 10 Worst ROI Home Improvements | Hettler Insurance, Lubbock Texas

-- Life Insurance Instant Quote and Apply Tool @ GetLifePolicy.com > * Quick self-service term life insurance quote. With or without medical exam.

-- Call us about Auto, Home, Business, Life, or Health insurance. * Click to Call (806) 798-7800, Mon-Fri 8:30am-5pm (lunch closed Noon-1pm)

-- Come see us @ our new address 4720 S Loop 289 Lubbock, TX 79414 (maps link), or get your online quote started at https://GetHettler.com