Auto Insurance. You may think of it as a paper stuffed in your glove box that allows you to legally drive in the U.S. That hard copy, though, is actually the contract you made for an exchange of money for coverage. When you purchase car insurance, you are buying security. If damage occurs to your property, health, or others during a collision, theft or natural cause, you have monetary stability because of your auto insurance policy. Or, do you?

Drivers tempted by an additional income stream from Uber, Lyft, Turo, Sidecar and other startups in the rideshare economy, should take a deeper look and consider the very real insurance consequences of engaging in such activities.

The Rideshare Economy

The modern “rideshare economy” has challenged some of the most established businesses in the United States. The idea that anyone can freelance their time and their own vehicle to make money has never been easier with smartphones and mobile apps.

The problem with ridesharing is it’s still a relatively new concept and the car insurance industry has only begun to catch up.

If you are a millennial, many of you are likely familiar with Uber, Lyft, Turo and other major players in the rideshare economy. For everyone else, here is a brief refresher.

Uber & Lyft

Uber & Lyft employ thousands of drivers to taxi everyday consumers around the globe. Becoming a driver with either service is relatively easy. You do need a car, and it often needs to be a 2005 and newer, depending on the city. Tack on a driver’s license, age requirement of 21 years or older, personal insurance, a background check and you’re set to drive either full time or only for a few hours a week.

Once approved as a driver with either service, you will start getting requests via a mobile app to chauffeur passengers in your city. Expect to earn near $19 an hour depending on volume and times.

In Texas, Uber and Lyft are available in most cities, although surprisingly Austin is no longer one of them. As of 2017, Uber and Lyft are still not available in Austin and may leave Houston altogether.

Turo

A newcomer compared to Uber and Lyft, Turo allows anyone to list their car online and via an app for rental. Disruptive of the traditional car rental industry, Turo converts an idle car into a passive money making machine connecting renters with everyday car owners.

Renters are screened and can be denied or approved by owners. Once approved, the keys are handed over and the renter drives the car for an hour, to several days depending on what is determined up front.

Commercial Use vs. Personal Use Insurance

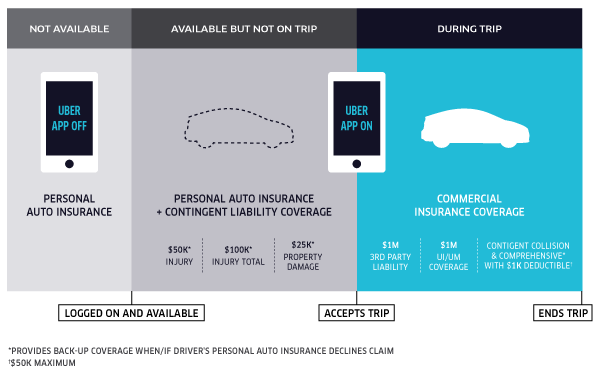

Although all three providers claim adequate coverage during “commercial use”, problems do arise. Commercial use is simply when the vehicle is being used for commercial purposes vs. personal use – the Uber or Lyft app is off or not engaged and your vehicle is being driven for leisure. Uber even published a handy diagram to better explain the hand off between personal and commercial auto coverage.

For Turo, commercial use is defined as the delivery period (i.e., the period starting when the owner is actively delivering the car to the renter and ending when the car is delivered to the renter). For the renter, commercial use is defined as (receiving the keys to the car from the owner and returning the keys to the owner.)

For Turo, commercial use is defined as the delivery period (i.e., the period starting when the owner is actively delivering the car to the renter and ending when the car is delivered to the renter). For the renter, commercial use is defined as (receiving the keys to the car from the owner and returning the keys to the owner.)

In April of 2016, Progressive partnered with Uber to help insure Texans employed by the rideshare company. If you are an Uber driver, sign up for Progressive’s Snapshot which tracks driving habits and commercial vs. personal use.

5 Important Considerations Before Signing Up

1. Your personal insurance policy becomes void during commercial use

It’s important to note that during a period of commercial use, your personal insurance policy is no longer valid. Instead your coverage is based on the requirements, rules and protection of Uber, Lyft and Turo. These companies do not employ an insurance agent to walk you through the coverage, it is on you. In fact, they have made it so simple to sign up, that many drivers accept the terms without a second look.

Turo published a detailed 1,500 word overview on the comprehensive, collision and liability coverage that are and aren’t included. However, it requires a conversation with your auto insurance agent to truly understand what coverage you are losing during commercial use and the scenarios that can leave you without coverage.

For example, when it comes to bodily injury, property damage, PIP, and UM/UIM, Turo states:

“…Turo has either waived this coverage entirely or subscribed to the lowest limit allowable by state law, and members are bound by such election and agree to be so bound, as per the Terms of Service.”

In regards to physical damage to the car, Turo states:

“…if the car is lost, stolen, or damaged so extensively that the expected cost of repairs exceeds 75% of the actual cash value, the renter is responsible to pay the entire actual cash value of the car, plus all Related Costs, minus any residual salvage value.”

2. Your personal auto insurance policy could be void all the time

Your personal insurance policy could be void even by engaging in commercial activity, even if part time. It largely depends on your state, city, carrier and policy. Many carriers even drop policyholders simply when finding out that they are a ride share driver or owner.

Texas passed a law in January of 2016, that required drivers of Transportation Network Companies (TNC), to carry higher auto insurance limits. If you currently have state minimum coverage and are driving for Uber or Lyft, you wouldn’t be eligible to file a claim.

Other carriers limit coverage during periods when an app is engaged, but a passenger has not yet been picked up. These are grey areas of coverage that could require commercial auto insurance or a special ride share policy.

In Texas, Geico and USAA are the first to offer special rideshare policies to drivers of Uber, Lyft and Turo.

3. Low mileage discounts can be revoked

If you are currently benefiting from a lower premium due to “low mileage” which tends to be applicable to vehicles driven less than 10,000 – 15,000 miles per year, signing up on any ride sharing service is sure to get it revoked.

A typical Uber driver adds on 100 – 300 miles per day to their vehicle. That’s going to get the attention of your personal auto insurance carrier, and could even increase cost of your personal policy, despite high mileage happening during your employer’s time.

4. Be prepared for an increased number of small insurance claims

If a renter with Turo earns a scratch on your new Mustang during rental, without pictures of all damage beforehand, it is on you as the owner and your auto insurance policy to cover minor damage.

For those of us in Texas, the more someone else is driving our car, truck or SUV on the highway, the increased chance you could see a cracked windshield upon return.

5. Don’t trust all drivers, renters or owners on the app

Just because these companies have a global presence and a slick app, doesn’t mean all users are without fault. One user of Turo in Irving, TX ranted about her experience with the company and renters. In short:

- Users reported electrical issues with her car, which Turo required her to fix without reimbursement

- A renter parked her car in a paid spot at her apartment community, earning her a towing bill and trip to impound

- She experienced the aftermath of renters that smoked and drank in her vehicle

What Should You Do?

Check with your insurance agent first if your auto policy covers or excludes certain aspects of ride sharing.

Under no circumstances should you lie to your agent. This can actually give your insurer the legal right to cancel your policy. Always be up front with your agent about any ride sharing activities you anticipate. They can help you navigate what is and isn’t covered and if a special ride sharing auto insurance policy is needed.

-- Life Insurance Instant Quote and Apply Tool @ GetLifePolicy.com > * Quick self-service term life insurance quote. With or without medical exam.

-- Call us about Auto, Home, Business, Life, or Health insurance. * Click to Call (806) 798-7800, Mon-Fri 8:30am-5pm (lunch closed Noon-1pm)

-- Come see us @ our new address 4720 S Loop 289 Lubbock, TX 79414 (maps link), or get your online quote started at https://GetHettler.com