Did the DMV tell you to file an SR-22? If so, you probably have something on your driving record you’d rather not talk about. But it’s important to get over your embarrassment and be honest with your insurance agent. If you’re staring down an SR-22 certificate, here’s what you need to know.

What is An SR-22?

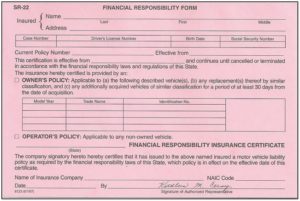

SR-22 is often referred to as high-risk insurance. But actually it’s a certificate of financial responsibility. In other words, an SR-22 is proof that you’re carrying sufficient liability insurance on your vehicle. People have to file an SR-22 when they start driving again after their suspended or revoked license is reinstated.

What causes an SR-22?

- Convicted of driving under the influence (DWI)

- Caught driving uninsured

- Involved in an injury-causing accident

- Multiple speeding tickets

- Too many points on a driving record

- If you own a high-performance luxry car

- If you have poor credit

Fees for SR-22’s vary depending on the individual, but expect them to be higher than drivers without an SR-22. Also, your insurer may require upfront payment for the full term of the policy, rather than collecting month to month. It’s important to keep your SR-22 certificate valid. In Texas, insurers automatically notify the Texas Department of Public Safety when an SR-22 lapses, terminates or is canceled.

Is an SR-22 Forever?

In Texas, the DPS requires SR-22 insurance for 2 years. But if you commit a new violation within the initial mandated period, you may have to extend your SR-22 compliance. On the other hand, if you’re a model citizen, have no incidents of violations within the specified time period, and faithfully maintain your SR-22 responsibility, you’ll eventually be able to buy ordinary car insurance again.

You can improve your reputation in the eyes of your insurance carrier by:

- Completing a defensive driving course

- Improving your credit

- Driving a safe, reasonably priced car

- Avoiding accidents and traffic violations

How Do You Get High-Risk Insurance?

The first thing to do is talk to your insurance agent. Does he or she offer SR-22 or high-risk auto insurance? If not, shop around with online or brick and mortar insurance companies. Some companies offer high-risk policies online.

In Texas, drivers can qualify for Texas Automobile Insurance Plan Association (TAIPA) after being rejected by two insurance carriers. TAIPA offers the minimum required by law – liability, uninsured/underinsured motorist and personal injury protection – but no collision or comprehensive. It’s more expensive than insurance available to average drivers. Motorists on the TAIPA plan have extra motivation to behave, as they’ll reap surcharges for traffic tickets and accidents. TAIPA drivers who become better roadway citizens can expect drops in their insurance costs after one to three years of good behavior, depending on the insurer.

Tips for Getting Coverage

The most important tip is don’t give up! If you need to drive, you need insurance. So keep shopping.

Try the little guys. Some of the big insurance carriers might not give you the time of day, but small firms and independent agents are often more willing to listen and find a workable plan. Contact agents who work with as many different auto insurers as possible so they can help you shop for the best deal. Remember, smaller, local insurance companies are more likely to approve risky drivers.

Do you need somebody who will take time to give you the personal care you need? Give us a call today.

-- Life Insurance Instant Quote and Apply Tool @ GetLifePolicy.com > * Quick self-service term life insurance quote. With or without medical exam.

-- Call us about Auto, Home, Business, Life, or Health insurance. * Click to Call (806) 798-7800, Mon-Fri 8:30am-5pm (lunch closed Noon-1pm)

-- Come see us @ our new address 4720 S Loop 289 Lubbock, TX 79414 (maps link), or get your online quote started at https://GetHettler.com