Tesla is famous for cool innovations. So it makes sense that if any automaker could pre-sell 400,000 cars based on a prototype, it would be Tesla. Early adopters eagerly await their new electric luxury sedans, which are due to start shipping in October. But what about insurance? Rates are based on pesky facts like how likely cars are to cause damage and how expensive they are to repair. In the absence of crash data, insurers are guesstimating what to charge to protect the new Tesla Model 3.

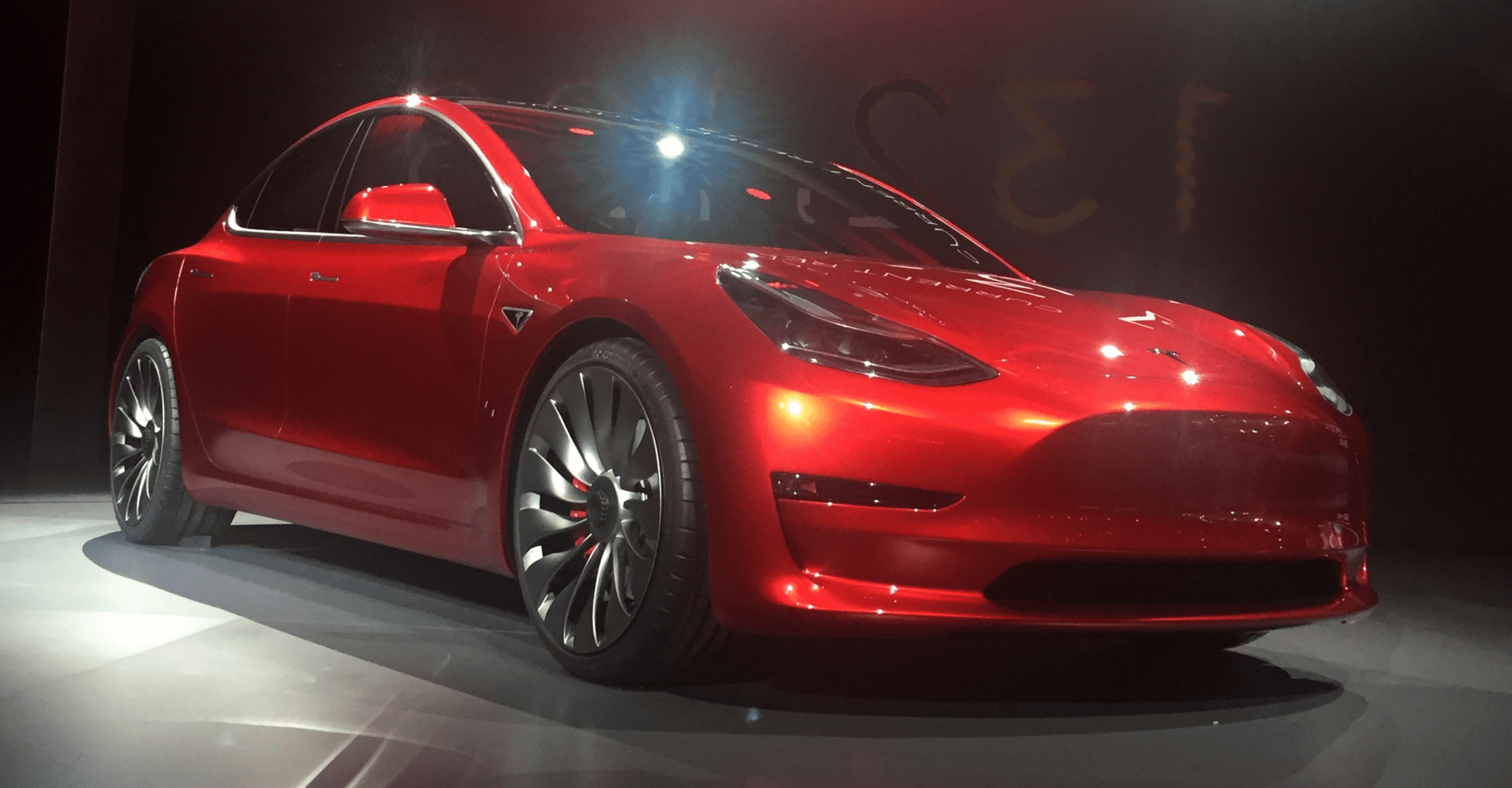

Meet the Tesla Model 3

Tesla has scaled back the size, luxury and features of its Model S to build a car at half the cost. Still, at $35,000 we can’t really deem it a budget option. Government incentives to buy an electric car may help sweeten the deal.

Features of the new Tesla include acceleration from 0 to 60 in just over five seconds, a range of 220 – 310 miles per electric charge, seating for five adults and a 15 inch center touchscreen. Unlike the Model S, which includes unlimited supercharging, Model 3 owners must pay an as-yet undisclosed amount per charge. Tesla assures us that this will be less than the cost of a tank of gas.

In 2018, Tesla will start producing an all-wheel drive version of the Model 3 and delivering left-hand drive vehicles internationally. In 2019, people in right-hand drive countries will finally have a shot at the new car.

Auto Insurance Issues

Aside from the lack of crash data, the Tesla 3 has two factors that can lead to higher auto insurance rates: it’s electric, and it’s a luxury car.

A Value Penguin study looked at four electric cars. It found that while rates varied wildly, major insurers charged more to cover electric cars than their gas-guzzling cousins. This ranged from 1.07 to 1.45 times the cost, depending on the electric car model and insurance company. This isn’t because drivers of electric cars engage in riskier motoring practices. It’s because electric cars cost more, and so have a higher replacement cost. Since electric cars are usually smaller, they may be likelier to get stolen and also to be totaled in an accident. Perhaps this rate disparity will change if electric cars become the norm. But for now, eco warriors must pay for their good deeds.

Of course, luxury cars cost more to insure for the same reason. They’re more expensive cars, so they cost more to fix and replace. As far as the cost for collision insurance, luxury cars are right up there with sports cars.

Jeff Evanson, Tesla’s VP of Global Investor Relations, said earlier this year that Tesla might provide an insurance policy for its drivers. They currently offer policies to some of their customers in Asia.

So How Much Will it Cost?

So far, we’re guessing. But in New York, drivers can insure their $70,000 Tesla Model S for about $1,750 a year. A $32,000 Kia Soul EV costs about $1,446 to insure in New York. So Model 3 drivers in New York might be looking at a little over $1,500 to insure their new ride.

Pay as You Go

Usage based insurance or mileage insurance options could prove to be good for Model 3 owners, something we’ve written about previously. We can guess that they’re highly interested in doing the Eco thing. So owners are likely walking and biking a fair deal and driving less than many motorists who aren’t so focused on sustainability. Knowing that they can only go 220 miles before charging, and that charging stations aren’t as easy to find as gas stations, also cuts down on purposeless driving. For these reasons, we’re guessing that fewer miles driven could make pay as you go options a sensible choice.

Final Word

Our last prediction (for today, at least) on the Tesla Model 3 and insurance rates: Be prepared for them to change. As more real world data becomes available on their performance, safety and repair costs, rates could go up or down. But early adopters are comfortable with risk. For now they’ll live on the edge and hope the new car lives up to Tesla’s hype. If it does, expect lower insurance rates based on claims data within a couple of years.

-- Life Insurance Instant Quote and Apply Tool @ GetLifePolicy.com > * Quick self-service term life insurance quote. With or without medical exam.

-- Call us about Auto, Home, Business, Life, or Health insurance. * Click to Call (806) 798-7800, Mon-Fri 8:30am-5pm (lunch closed Noon-1pm)

-- Come see us @ our new address 4720 S Loop 289 Lubbock, TX 79414 (maps link), or get your online quote started at https://GetHettler.com