Lubbock Texas Hits a New Population Milestone

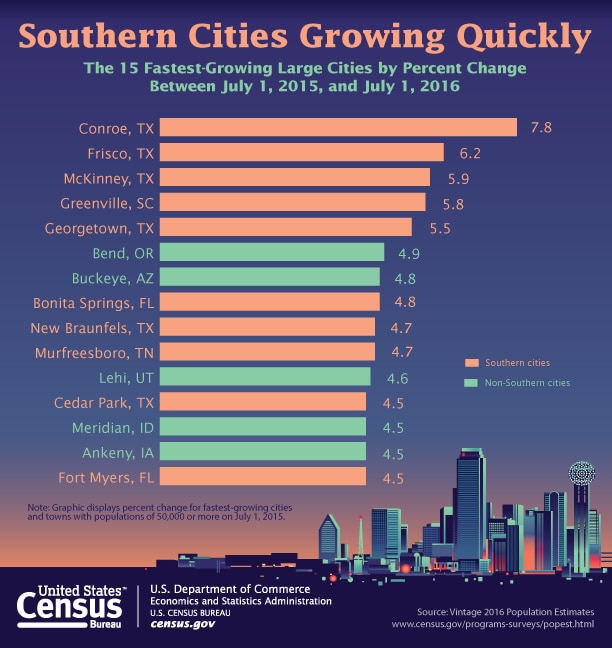

Last month, the U.S. Census Bureau revealed the fastest-growing large cities. Four of the top five were in Texas: suburbs of Dallas, Houston, and Austin.

Although Lubbock is defined by the Census as a large city (more than 50,000), it didn’t reach record growth. Instead, the Census revealed Lubbock reached a new milestone. Officially, it broke 250,000 full-time residents and Lubbock County reached 300,000+ residents.

Growth Can Be Good for Insurance

When cities grow, it can provide many benefits, such as visibility. In the last 3 years, many chains and retail outlets opened in Lubbock for the first time. These include Costco, Cabela’s, Dunkin Donuts, Steak ‘n Shake, Potbelly Sandwiches and even Texas chains such as Torchy’s Tacos and Alamo Drafthouse. According to Lubbock in the Loop, In-N-Out Burger is even coming to the Hub City!

Lubbock has quickly become the destination for franchise chains to reach new customers. However, restaurants aren’t the only business to rely on growth and population estimates from the Census. Insurance companies, some new to the region bring competition by writing new policies in Lubbock County for the first time. While existing carriers expand the number of adjusters and claim representatives. This affects insurance in two ways, claims become less expensive and insurance premiums become more affordable.

Compare Lubbock County to Crosby County, Texas. Crosby Country has a population of just 6,059. We will see how a bigger population benefits residents. There’s many more choices of insurance carriers in Lubbock, with several not even serving nearby Crosbyton.

Different types of insurance can be affected more than others. Health insurance becomes much more expensive in rural areas due to limited access. Specialty medical care and preventative healthcare may not be available for hundreds of miles. Even a routine emergency room visit costs thousands more as the distance to a hospital is greater.

The Relationship of Population and Insurance

Insurance companies have their own wealth of data. It’s called their claims data. The quantity of claims, average payout of claims, and type of claim can lower or increase the cost of insurance coverage. Whether a claim is comprehensive or collision for auto insurance or personal property claims, liability claims and structure claims for renters and homeowner’s policies. Each of these components of coverage can be affected by population.

If cities grow the wrong way or too quickly, insurance can be negatively impacted. Leaving Lubbock for Austin? Depending on your auto insurance company, you’ll likely experience an increase in premiums. Why? This is due to a higher number of collision claims in Austin compared to the population. Not only is the city notorious for bad traffic, all those cars lead to more accidents. In comparison, Lubbock is often ranked as the best city for commuters with less time required, as there are fewer cars and better roads.

If cities grow the wrong way or too quickly, insurance can be negatively impacted. Leaving Lubbock for Austin? Depending on your auto insurance company, you’ll likely experience an increase in premiums. Why? This is due to a higher number of collision claims in Austin compared to the population. Not only is the city notorious for bad traffic, all those cars lead to more accidents. In comparison, Lubbock is often ranked as the best city for commuters with less time required, as there are fewer cars and better roads.

Natural Disasters, Population & Insurance

Moving from Lubbock to San Antonio and want comprehensive car insurance? Expect to pay more for a premium as damaging hail storms increased comprehensive claims, which increased costs for policyholders. Thousands of cars were totaled in 2016 alone! Natural disasters like hail storms and tornadoes wreak more havoc in populated areas. If storms in Lubbock become more severe, the cost to insure buildings will continue to increase as the population grows.

Moving from Lubbock to San Antonio and want comprehensive car insurance? Expect to pay more for a premium as damaging hail storms increased comprehensive claims, which increased costs for policyholders. Thousands of cars were totaled in 2016 alone! Natural disasters like hail storms and tornadoes wreak more havoc in populated areas. If storms in Lubbock become more severe, the cost to insure buildings will continue to increase as the population grows.

Crime, Population & Insurance

Crime tends to increase claims, although the relationship between population and crime isn’t aligned. Renter’s and homeowner’s premiums in Austin will likely be lower than Lubbock. As the risk of personal property theft is higher with Lubbock’s crime rate, determined by population and crimes per capita.

There are several reasons Midland and Odessa have the worst crime rate in the state. The cities have a high number of workers connected to one industry, oil which goes boom or bust. During an oil boom, the population swells and hopeful workers from all over the country move to the Permian Basin. The biggest motivator is money, which doesn’t always bring the best citizens. During a bust, the unemployed often resort to drugs and crime.

If Lubbock’s wind or oil industry begins booming, the population can grow quickly and attract the same bad apples as the Permian Basin. For Lubbock’s growth to be a benefit, attracting workers permanently is key to a stronger local economy, less crime, and lower insurance rates.

-- Life Insurance Instant Quote and Apply Tool @ GetLifePolicy.com > * Quick self-service term life insurance quote. With or without medical exam.

-- Call us about Auto, Home, Business, Life, or Health insurance. * Click to Call (806) 798-7800, Mon-Fri 8:30am-5pm (lunch closed Noon-1pm)

-- Come see us @ our new address 4720 S Loop 289 Lubbock, TX 79414 (maps link), or get your online quote started at https://GetHettler.com