Contact Info

send us a message

Read The FAQ’s

The typical homeowners policy has two main sections: Section I covers the property of the insured and Section II provides personal liability coverage for the insured. Almost anyone who owns, or leases/rents, property has a need for this type of insurance. Usually, homeowners insurance is required by the lender to obtain a mortgage. And, many landlords require Renter’s Insurance.

In addition to your age, gender and driving experience, information about the car you drive, and your driving record, is also needed to determine a fair price for auto insurance. For example, a large luxury car costs more to repair or replace than a compact car. Also, someone in Lubbock who commutes 30 miles each way is more likely to be in an accident, than someone who commutes via bus and only drives on weekends.

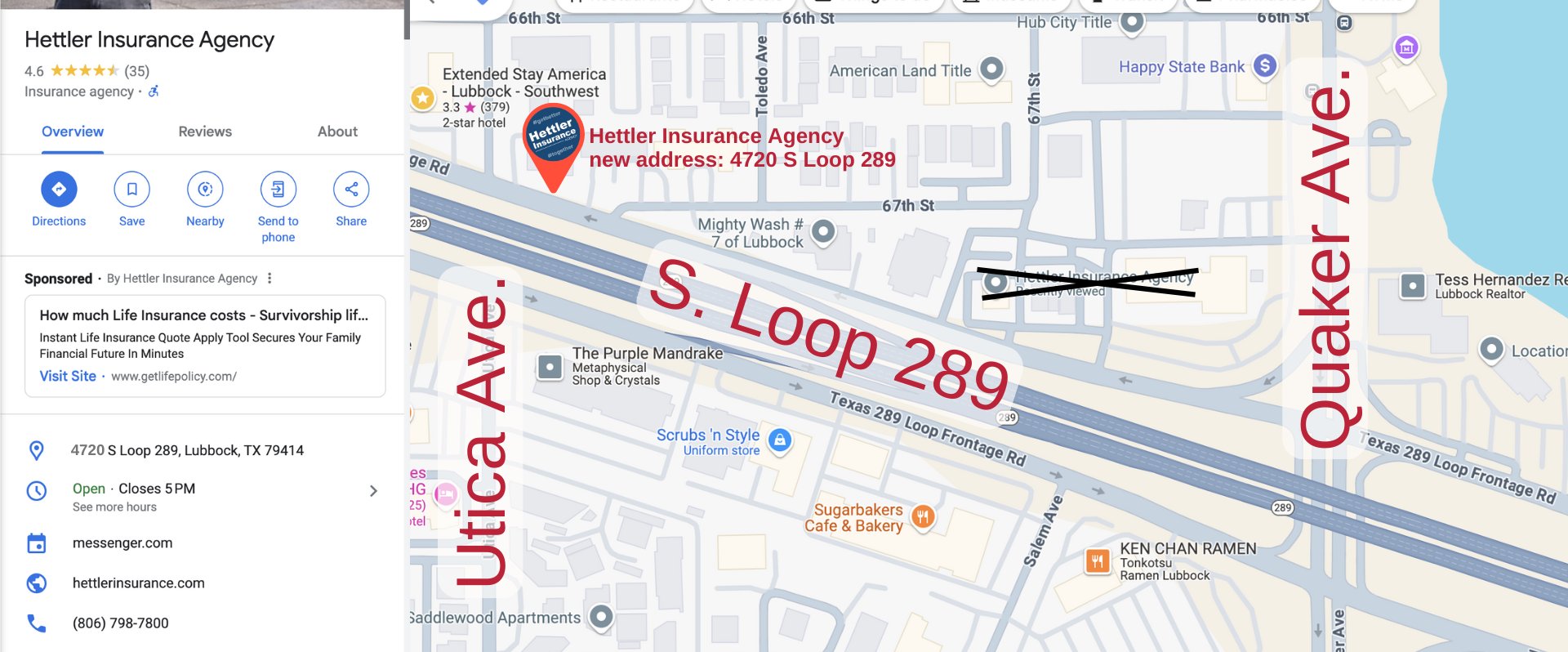

We do the shopping so you don’t have to; you have better things to do. You don’t have to do insurance alone. By using an independent insurance agent such as Hettler Insurance Agency, you receive more personalized service. Having direct contact with your Agent can be very important when purchasing insurance, and absolutely necessary when filing a claim. We deliver quality insurance in Lubbock, TX, and statewide, with competitive pricing and local, customized service.

Collision physical damage coverage is defined as losses you incur when your car collides into another car or object. For example, if you hit a car in a parking lot, the damages to your car will be paid under your collision coverage. Comprehensive physical damage coverage provides coverage for mostly other direct physical damage losses you could incur, including theft. For example, damage to your car from a hailstorm will be covered under your comprehensive coverage.

A number of factors can affect the cost of your car or auto insurance in Texas – some of which you can control and some that are beyond your control. The type of car you drive, the purpose the car serves, your driving record, and where the car is garaged can all affect how much your car insurance will cost you in Lubbock, TX, or statewide. Even your marital status can affect your cost of insurance. Statistics show that married couples tend to have fewer and less costly accidents than those who are single.